It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. To wit, the Uno Minda Limited (NSE:UNOMINDA) share price has flown 264% in the last three years. That sort of return is as solid as granite. In the last week the share price is up 1.4%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Uno Minda

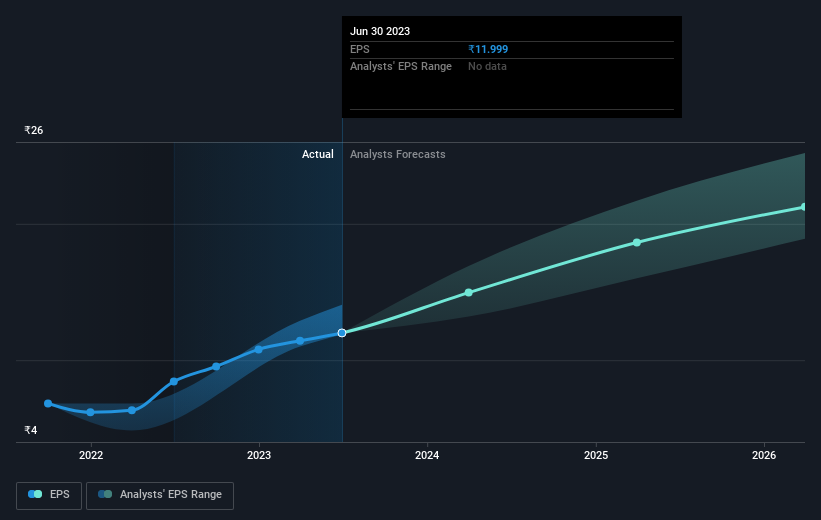

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Uno Minda became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Uno Minda has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Uno Minda stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Uno Minda shareholders gained a total return of 7.8% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 28% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Uno Minda is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Uno Minda is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Author: Madeline Robinson

Last Updated: 1700258641

Views: 2683

Rating: 4.2 / 5 (104 voted)

Reviews: 83% of readers found this page helpful

Name: Madeline Robinson

Birthday: 2001-06-27

Address: 98226 Christopher Club Apt. 100, East Michaelmouth, CT 36786

Phone: +3675995515712163

Job: Museum Curator

Hobby: DIY Electronics, Arduino, Juggling, Poker, Cycling, Archery, Skateboarding

Introduction: My name is Madeline Robinson, I am a striking, capable, steadfast, dear, enterprising, venturesome, receptive person who loves writing and wants to share my knowledge and understanding with you.